Aave News #66

Merge, SoLo, New Grant Recipients, September Community Call Recap, and the Next rAAVE. On Polygon v3, stMATIC was added & an AIP to add MaticX is live.

Happy Merge! Did you collect the post of the historic day? This week Aave News covers: Spotlight 🔦 | Protocol 📰 | Ecosystem 🧉 | Risk 🔎 | Governance ⚖️ | Events 📆 | Hey Anon 👻 | Community Call ☎️

Spotlight: SoLo 🔦

Under-collateralized loans? Yes, please. The SoLo Protocol allows individuals to compute a unique credit score (dubbed the SoLo score), based on their off-chain open banking data and on-chain wallet analytics, to secure a personal loan. The first prototype is now open to the public, so head over to soulloan.io to learn more about under-collateralized lending in DeFi and find out your SoLo score. The first cohort of 200 users to successfully calculate their scores will receive the SoLo Early Bird NFT, offering a boost on a future potential airdrop!

Protocol 📰

stMATIC by Lido Finance is live on the Polygon v3 Pool after a successful on-chain vote. This is the first liquid staking derivative of MATIC on Aave. MaticX by Stader Polygon is not far behind as it is currently up for vote.

Hopefully all of Aave fam enjoyed the Merge 👻

Ecosystem 🧉

We shared an August update on Aave Grants including announcing new grantees, our current status and quarterly milestones. Congrats to all the teams!

Read a recap of the latest Aave Grants community call including updates from Aave Co, the community and four grantees, or keep reading for the full set of notes at the bottom of Aave News.

The Kyiv Tech Summit wrapped up last week with a surprise appearance from Vitalik. Congrats to all the hackers including LenScore by redstone.finance that calculates a score based off of your Lens Protocol data.

Check out the latest issue of the Crypto Grants Wire by Sov for updates from across the crypto grants ecosystem including Aave, ENS, Ethereum Foundation, Gitcoin, Hop and more.

Grantee Gateway DAO had the mainnet launch of their Web3 Credentialing Protocol.

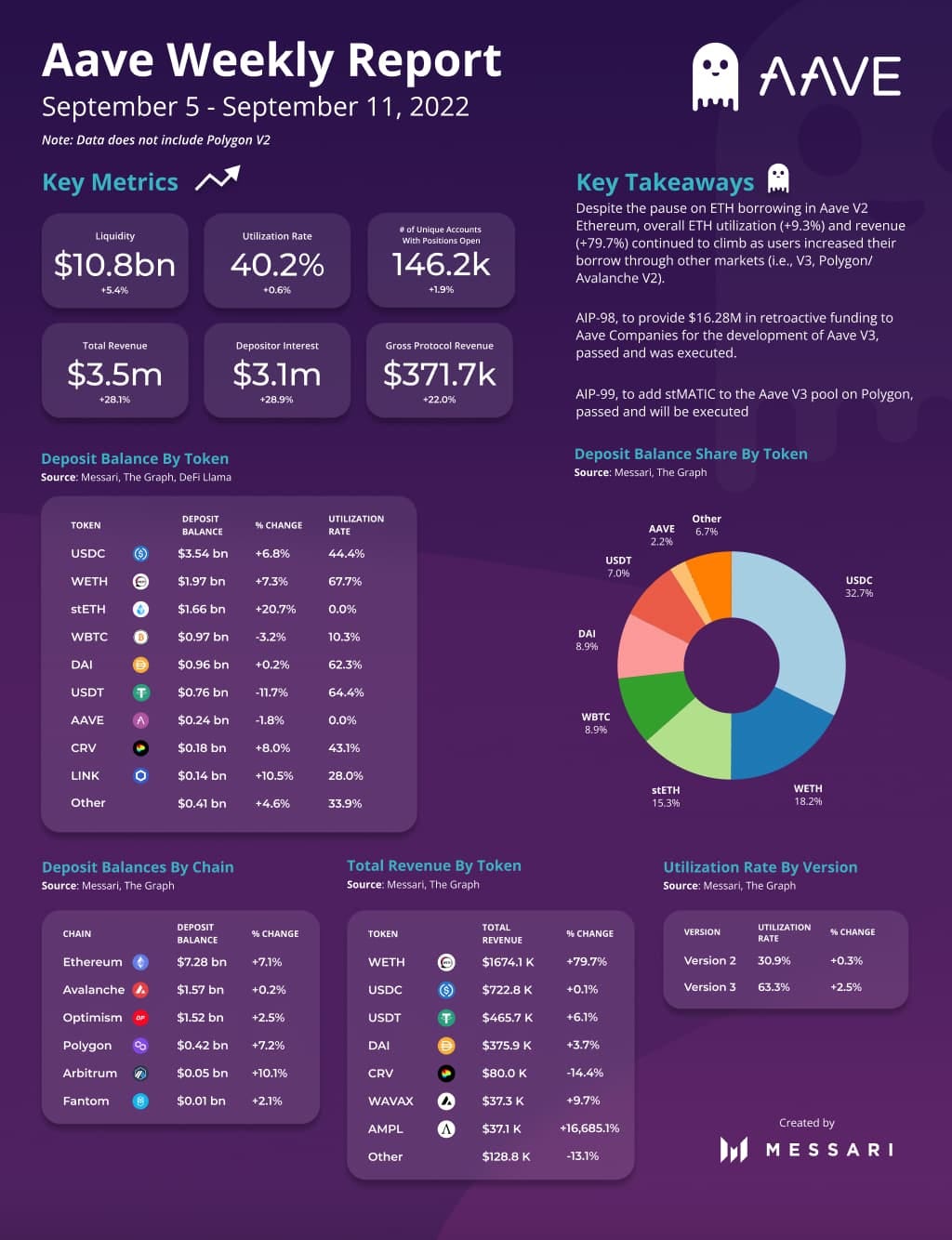

Messari shared their Aave Weekly Report highlighting deposit balance by chain, revenue by token and gross protocol revenue.

Risk 🔎

Re-enable ETH Borrowing:

Details can be found in this AIP

AIP-97 paused ETH borrowing on the Aave V2 Ethereum market to mitigate the risk of high utilization ahead of the Ethereum Merge. This proposal re-enables ETH borrowing to revert the market back to normal conditions. Given the timing of the Merge, this proposal allows for a few days of monitoring post-Merge before this AIP can be executed. Should conditions turn undesirable, voters should vote No.

Analytics Dashboards:

Dashboard can be found here

Gauntlet has launched the Analytics Dashboard to provide the community with greater insight into key protocol metrics. The dashboard provides statistics on supply, borrow, usage, liquidations, and debt repayment. These analytics dashboards are in addition to Gauntlet’s existing Aave Risk Dashboard.

In addition, Gauntlet has published Dashboard FAQs to provide the community with more resources to understand Aave’s market risk.

Governance ⚖️

On-chain votes:

Add MaticX to Aave v3 Polygon Pool | Governance discussion | 🗳 Vote until September 16th

Re-enable ETH Borrowing | Governance discussion | 🗳 Vote until September 16th | Read more in Risk 🔎

Snapshot votes:

[ARC] Add new KNC to Aave v2 and v3 | Governance discussion | 🗳 Vote until September 15th

Other discussions from the forum:

RFC. Aave Governance. Adjust Level 2 requirements (long-executor) | Update from bgdlabs on the smart contracts, a diagram breaking down each execution step and other important considerations.

[ARC] Deploy BAL to veBAL | Llama outlines two options for deploying the ~100k BAL acquired by Aave DAO in a previous governance proposal.

Proposal: Llama <> Aave | 12-month proposal from Llama to work on treasury management, protocol upgrades, growth, and analytics.

Chaos Labs - Risk & Simulation Platform Proposal | Proposal from Chaos Labs for their Risk & Simulation Platform.

ARC - Strategic Partnership with Balancer Part #2 | The 100k BAL purchase payload is 95% and will be submitted for an on-chain vote in the next couple of weeks.

Liquidity Mining Upgrade for Aave Arc - New Contributor Request | Proposal to upgrade the Aave Arc contracts to support liquidity mining.

[ARC] Whitelist Balancer’s Liquidity Mining Claim | Proposal from Llama to allow Balancer DAO to claim their stkAAVE liquidity mining rewards.

Events 📆

ETHOnline 📠 - September 2 – 30

ETHBogotá 🇨🇴 - October 7 – 9 → Apply to hack today!

Devcon 🇨🇴 - October 11 – 14

DAS: LONDON 🇬🇧 - October 17 – 18

rAAVE ✨ - ???

Hey Anon 👻

100 proposals. How many have you voted in?

Community Call ☎️

September 8th 2022, Twitter Spaces

[AGD] Shreyas - AGD Overview

executive summary of AGD

follow up form sent out tracking grantee completion rate

working on more accurate tracking of new TVL and new users acquired

[AGD] Fig - Community Grants RFPs

Top Priorities

Governance UI - facilitate votes, delegate, and monitor governance

Stablecoin growth - grow Aave’s stablecoin TVL and integrations

Credit Delegation - allows lenders to deposit into Aave earning interest and then delegate borrowing power users in need of borrowing credit

[Aave Co.] Stani - Aave Ecosystem General Overview

level of contributor engagement is still very high

starting to see an ecosystem forming around funding from the DAO

value capture from Aave protocol -> Aave DAO -> contributor ecosystem

retroactive funding model of Aave DAO towards long-term contributors could allow for a unique and competitive space for Aave

[Aave Co.] Mark - Technical Update

first audit round for GHO stablecoin is in from OpenZepplin with no significant findings

currently Aave Co. is writing tests and optimising for gas on contracts

writing technical paper for GHO which will be shared soon

Aave Co. has also seen an increase in dev activity around Aave GitHub with uptick in pull requests recently

[Community] Paul - Gauntlet current works

on-chain proposal to pause ETH borrowing before and during merge - executed:

intended to mitigate high utilization of eth going into the merge

for reenabling ETH borrowing post-merge gauntlet has put up a governance post

updates:

recently published an analytics dashboard

starting to work on V3 market integration into risk simulation platform

made pull request to add a disclaimer to borrower UI letting users know governance can change risk parameters based on market conditions

[Community] Ernesto - BGD current works

published governance post on how Eth merge will affect Aave protocol

continued work on proof of reserve integration with Chainlink

migration of Aave V2 -> V3 will involve two phases due to impact and complexity, phase one is done and phase two is in progress

post on Aave V1 sunset

working on aspects of on-chain governance to allow for control of all Aave pools cross-chain - will publish to the forum in the coming weeks and hope is it will set Aave as a leader in the space for that area

[Community] Juan - Penn Blockchain (Franklin DAO) delegation

creating a platform engaging actively in protocol governance of Aave - using ongoing knowledge from involvement in Compound and other governance spaces

[Grantee] Jack & Carl - Metrics DAO

covered recent build of flash loans dashboard that has allowed for interesting finds around flash loan use in Aave

Carlos explained two Metrics DAO products recently built for Aave:

Aave full user history detailing dashboard

[Grantee] David - Nakji Network

public beta is live for their API product

actively hiring and will be sharing lots of updates publicly on product and future plans shortly

[Grantee] DMars - Cryptoversidad

shared their 15 Aave animated videos series covering full ecosystem for folks new to the environment

[Grantee] Gloria - Orange Protocol

recent AGD NFT drop on Polygon for different types of Aave users