Aave News #72

Flaave Flash Lending, October Community Call, Precautionary AIPs, Proposal to deploy Aave on zkSync v2.0 Testnet & New aToken Primitive.

For anyone who joined the October Aave community call, including: Spotlight 🔦 | Protocol 📰 | Ecosystem 🧉 | Risk 🔎 | Governance ⚖️ | Events 📆 | Hey Anon 👻

// Spotlight: Flaave 🔦

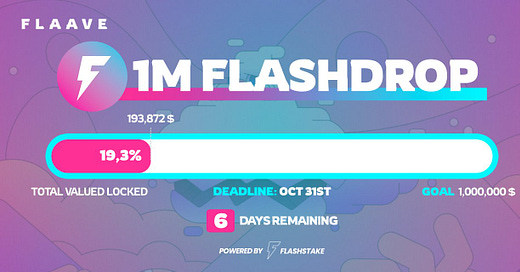

Flash lending by Flashstake went live last week! Users can earn up to one year's worth of lending fees paid instantly and upfront. Plus, there is 1M in FLASH rewards available if $1M is deposited before the end of October.

// Protocol 📰

The proposal to update the wMATIC parameters on the Polygon V3 Pool to increase capital efficiency is live for Snapshot voting.

Aave Companies shared a proposal for a new aToken primitive that would allow the Aave Protocol to participate in ve-based protocols like Curve and Balancer.

// Ecosystem 🧉

Thank you to everyone who tuned into the October Aave community call. Big shout out to all the speakers for making it possible: Thanks to all our speakers: @HelloShreyas @StaniKulechov @0x4Graham @pauljlei @eboadom @DMSchlabach @francisgowen @BenDiFrancesco @ZacharyDash & @ajbeal 👻

Check out the re-designed Deposit & Earn page on Sentible that helps users better explore opportunities. Start earning interest on your idle assets with support for Aave v3 coming soon 👀

Watch the head of smart contracts @bgdlabs, @The3D_, give a talk on "The Butterfly Effect – How Simple Oversights Turn Into Smart Contract Nightmares" at the DefiSecuritySummit.

// Risk 🔎 - written by Gauntlet

Aave V3 Ethereum Deployment:

Details can be found here

Following the community’s decision to deploy a new Aave V3 Ethereum, it is now time for the community to make important choices about how to design V3 ETH’s initial market structure.

Gauntlet provides recommendations in the forum post, and discussions are ongoing.

Risk Parameter Updates:

Details can be found in AIP 111 and AIP 112

Gauntlet proposed adjusting parameters across the Aave V2 Ethereum, Aave V2 Polygon, and Aave V3 Polygon markets.

Although Gauntlet’s analysis showed that an oracle manipulation-based attack analogous to the one that cost Mango Markets $117m is much less likely to occur on Aave, out of an abundance of caution, Gauntlet proposed the parameter changes above.

// Governance ⚖️ - written by Boardroom

Summary

Lots of action with proposals — see below. Here are the latest metrics from Messari.

Proposals

Aave Improvement Proposals (AIPs):

Risk Parameter Updates for Aave Polygon Markets (2022-10-21) (112). This proposal to “take precautionary measures on the Aave Polygon markets” succeeded with nearly 100% voting “YAE.” This proposal (and the one just below) arose out of this discussion on the forum. (A similar discussion was had on the Compound forums, leading to a proposal.)

Risk Parameter Updates for Aave V2 ETH (2022-10-21) (111). This proposal to “take precautionary measures on the Aave V2 Ethereum market, including parameter changes on six (6) assets on Aave V2” succeeded with nearly 100% voting “YAE.”

Recently active Aave Improvement Proposals:

FEI Reserve Factor Update (110). As part of the planned deprecation of FEI as a collateral asset, the Reserve Factor had been set to 100% in a previous proposal. Since then @bgdlabs has noticed that no variable borrow debt is being accrued and the fees for the Reserve Factor are not being directed to the Collector smart contract as they should be. BGD Labs is here proposing a temporary fix — setting the Reserve Factor to 99% — until the protocol itself can be updated to handle resetting to 100%. The proposal passed with nearly 100% voting “YAE” and was executed on October 23.

Whitelist Balancer’s Liquidity Mining Claim (109). “Balancer DAO seeks to retrieve around 1,500 stkAAVE from several Linear Pools.” This proposal passed with nearly 100% voting “YAE” and was executed on October 21.

🗣 Now on Snapshot:

Risk Parameter Updates for Aave V3 Avalanche: 2022-10-15. Here’s Gauntlet’s guidance, which is to adjust five parameters “to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets.”

Aave v3 Polygon wMATIC Interest Rate Update. Llama proposes to update “wMATIC interest rate parameters on the Aave Polygon v3 Liquidity Pool.”

Add TRYB to Aave V3 on Avalanche Network, Isolation Mode.

Requests for comment active this week:

Aave V3 Ethereum Deployment: Assets and Configurations. More ideas and discussion about how to structure the market.

In the Forums

Delegate platform updates: From @Kene_StableNode, @fig, @lbsblockchain, FranklinDAO, and @Llamaxyz.

Continuous formal verification report for September, provided by @MCERFSR for Certora.

“$GHST is a potential risk factor for Aave’s v3 Polygon deployment,” says @nonstopTheo on behalf of Risk DAO.

Aave v2 on zkSync 2.0 Testnet. @SA_Matterlabs proposes deployment.

On Twitter

Quick Gov Links: Governance FAQ | Governance Docs | Discord Governance Channel | Snapshot | AIPs | Aave on Boardroom

// Events 📆

What events should Aave Grants sponsor for the rest of the year and into Q1 and Q2? DM Aave Grants with suggestions.

// Hey Anon 👻

Have you seen these stats on Aave Grants?