Aave News #75

Gateway NFT for all Grantees to Claim, Aave on Aztec, Gauntlet Snapshot, Certora Renewal, 100K BAL Acquisition and More.

For daily Aave users, including: Spotlight 🔦 | Protocol 📰 | Ecosystem 🧉 | Risk 🔎 | Governance ⚖️ | Events 📆 | Hey Anon 👻

// Spotlight: Aave Grants Credential from Gateway 🔦

If you have received a grant from AGD then you are eligible to claim an Aave Grants NFT through @Gateway_xyz! Creating an on-chain credential will help build connections between grantees and allow other communities to engage with grant recipients.

// Protocol 📰

Aave is now live on Aztec - an open source protocol for non-custodial liquidity markets, now with full privacy and 12x lower gas fees than L1. Users can deposit shielded ETH AND DAI into Aave and earn yield from a fully decentralized liquidity protocol.

Llama shared October Financials for the Aave protocol including treasury balances, reserves across different chains, and financial statements.

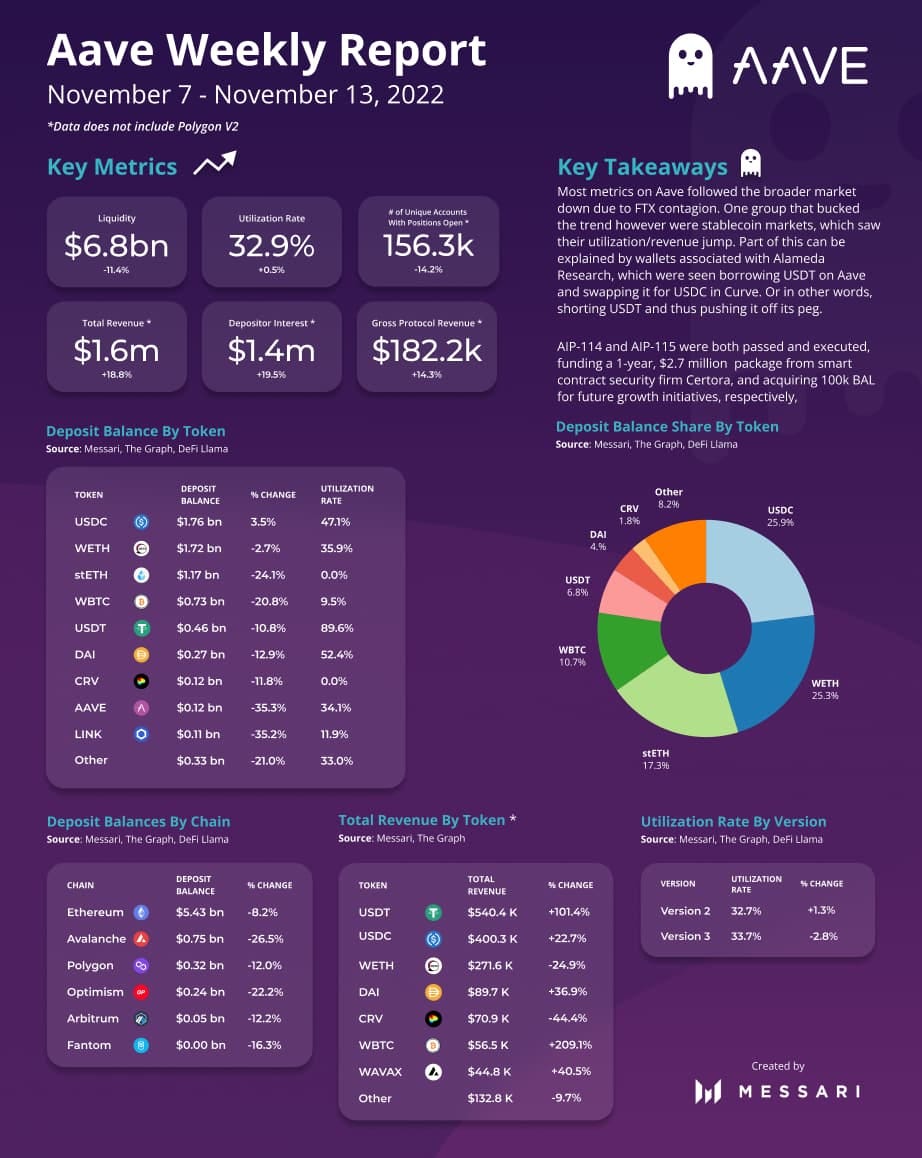

In governance, the Gauntlet <> Aave renewal is live for voting on Snapshot. Last week two AIPs successfully passed: renewing Certora’s work scope and deploying a bonding curve for the Aave DAO to acquire 100k BAL. Read about these governance proposals and more in Governance ⚖️.

If you made at least one contribution to the Aave Protocol interface in 2022 then you can claim a GitPOAP. Check out open issues in the Aave Github to see where you can contribute and be eligible for the next one.

Check out the latest Aave Weekly Metrics from Messari.

// Ecosystem 🧉

If you haven’t yet, check out the latest round of Aave Grantees! Learn about what each of them is building from on-chain credit scores to a new user interface targeting beginners.

The Aave V3 Bad Debt Dashboard from the Risk DAO is now live. Users can view the numbers of positions and total amount of bad debt on each network in real time. Read the teams overview and leave any feedback in the governance forum.

If you’re in Helsinki, make sure you swing by the Aave booth to meet the team, share ideas and ask any questions 🇫🇮🧣👻

// Risk 🔎 - written by Gauntlet

Aave V3 Ethereum Deployment:

Details can be found here

Following the community’s decision to deploy a new Aave V3 Ethereum, it is now time for the community to make important choices about how to design V3 ETH’s initial market structure.

Gauntlet provides recommendations in the forum post, and discussions are ongoing.

Asset Listing Risk:

Details can be found in this forum post

Gauntlet provides an analysis of the risks of adding USDT as collateral to Avalanche V3.

// Governance ⚖️ - written by Boardroom

Another long recap this week — which seems somehow appropriate, given everything.

/ Proposals

👻 Aave Improvement Proposals:

Risk Parameter Updates for Aave V2 ETH Market (2022-11-13)(119). This proposal freezes the BAL market on Aave V2 ETH in light of recent market volatility, as recommended by Gauntlet “out of an abundance of caution.”

Risk Parameter Updates for Aave V2 ETH Market (2022-11-13) (118).This proposal freezes the CVX market on Aave V2 ETH in light of recent market volatility, as recommended by Gauntlet “out of an abundance of caution.”

Risk Parameter Updates for Aave V2 ETH Market (2022-11-12) (117). This proposal freezes the REN market on Aave V2 ETH in light of recent market volatility, as recommended by Gauntlet “out of an abundance of caution.”

Add OP as Collateral to Aave V3 (116). As the title indicates, this proposal seeks to add OP as a collateral asset on Aave V3 Optimism — following a Snapshot vote in August in which almost 100% voted “YAE.” Risk parameters are noted in the proposal (though they are changed from the Snapshot proposal), and the Optimism Foundation offers to “seed incentives” to help build the liquidity pool. This would present a powerful use case for OP outside of governance. However, the proposal was put forward before Gauntlet was able to provide its risk analysis, which many say is especially important at this time.

Strategic Partnership with Balancer DAO Part 2 - 100k BAL Acquisition (115). This proposal is intended to complete the second part of Aave’s plan to acquire 300k BAL, which goes toward a strategic partnership long in the works. (Part 1 was accomplished through a token swap in July.) The ultimate goal is to support the growth of the Aave ecosystem, and veBAL presents “numerous opportunities” — including those put forward in two recent proposals (here and here). This proposal will allow for the on-market acquisition of 100k BAL by deploying a Bonding Curve contract. The proposal passed with 100% voting “YAE” and was executed on November 13.

Certora Continuous Formal Verification (114). This is the on-chain implementation of a recently passed Snapshot proposal in which Certora proposed to “improve the security of smart contracts built on top of Aave using a combination of formal verification and manual code review,” something which it has already been contracted to do for the DAO over the past six months. This proposal lays out the details of what Certora has accomplished and what it intends to do, offering to extend their previously established relationship by requesting a year-long commitment from Aave DAO at $2.7m. The proposal passed with 100% voting “YAE” and was executed on November 13.

⚡️ Recently on Snapshot

ERC4626 Strategies as Productive Collateral. Llama here proposes the introduction of a new collateral type that will allow “users to earn the rewards of other protocols by depositing into Aave v3 Reserves.” The proposal passed with 76.22% voting “YAE.”

🗣 Provide your feedback on these active Aave Requests for Comment (ARCs):

Aave V3 Deployment: Assets and Configurations. Gauntlet presents a table of options, and may soon initiate a Snapshot vote.

[ARC] Implementing a GHO Backstop for Aave. “B.Protocol would like to propose Aave DAO add a user-based backstop for GHO that will enable safer and more robust liquidation mechanics that can ensure peg stability also for less liquid collaterals as well as during radical market conditions.”

[ARC] stMATIC Emission_Admin for Polygon v3 Liquidity Pool. @llamaxyz proposes “assigning the stMATIC Emission_Admin role on the Aave v3 Polygon Liquidity Pool to a Gnosis Safe controlled by the Polygon Foundation.”

[ARC] LDO Emission_Admin for Polygon v3 Liquidity Pool. Llama proposes “amending the Emission_Admin address to enable the distribution of LDO rewards.”

/ In the Forums

Market downturn: @pauljlei from Gauntlet presents an analysis — followed by three AIPs for REN, CVX, and BAL (see above).

Financial report for October 2022, from Llama.

Delegate platform updates from FranklinDAO and @lbsblockchain.

Messari Governor Note re staked aTokens. Check out the write-up by @tnorm.

Harmony recovery. Discussion continues.

Alternative UI for non-DeFi users. @Sejal from DAOLens requests feedback on some ideas.

New governance UI? @D3Portillo from Radish makes a proposal.

Roadmap update from @OriN of Chaos Labs, following their successful governance proposal.

/ On Twitter

What crypto needs: Community governance, and more ungovernance, says @StaniKulechov

Aave IPFS UI: Improving state Management.

/ In Discord

Looking for feedback: @nonstopTheo requests some thoughts about how “we get standardized trade volume stats for asset onboarding + risk mgmt.” (See forum post here.)

Quick Gov Links: Governance FAQ | Governance Docs | Discord Governance Channel | Snapshot | AIPs | Aave on Boardroom

// Events 📆

Slush - November 17 - 18th

ETH Gathering - November 19 - 20th

// Hey Anon 👻

DeFi.