Aave News #80

Aave Made Crystal Clear with DeFi Teller, Internal GHO Testnet, AGD Renewal Proposal and Status of V3. Plus, Updates from Fluidity IncrementHQ & Buckets.

For anyone who subscribes on Mirror, including: Spotlight 🔦 | Protocol 📰 | Ecosystem 🧉 | Governance ⚖️ | Events 📆 | Hey Anon 👻

// Spotlight: Detailed 2023 Aave Review from DeFi Teller 🔦

Watch ‘Aave V3 Made Crystal Clear! Detailed 2023 Aave Review. DeFi Lending Explained in Simple Terms’ from DeFi Teller! An easy to understand breakdown of the core concepts underlying everything about Aave from liquidation threshold and health factor to interest rates and the different versions of Aave - all with simple explanations, clear graphics and detailed examples. This is the new go-to Aave 101 resource!

// Protocol 📰

GHO was the focus of a recent Cryptoeconomic research report from ConsenSys: Introducing GHO and Situating it in the Stablecoin Ecosystem

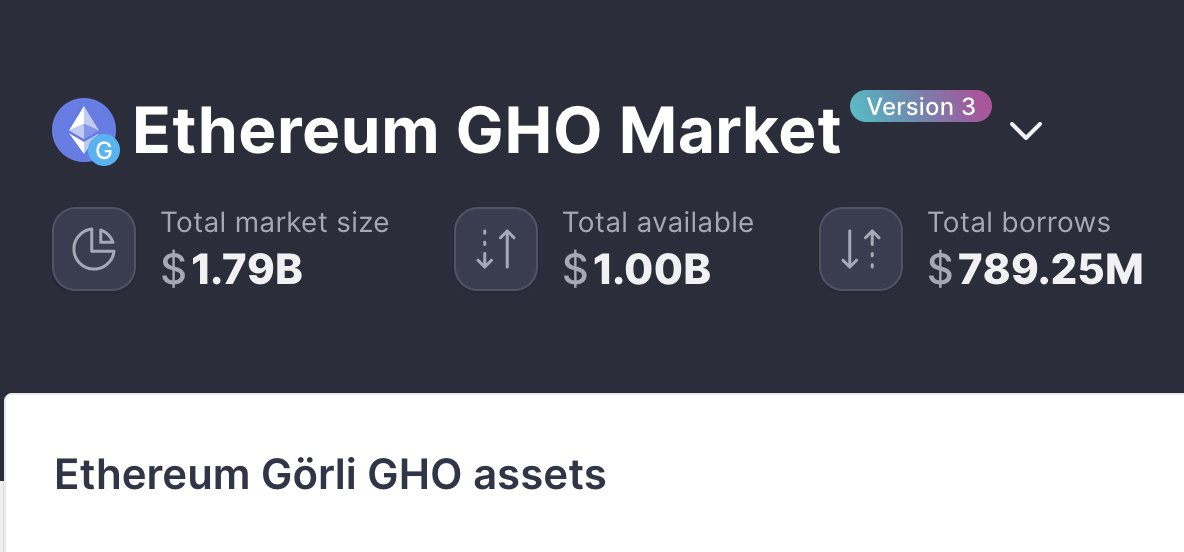

Stani shared that the internal testnet for GHO is continuing to grow - WEN mainnet!?

// Ecosystem 🧉

Aave Grants DAO shared the fourth renewal proposal on the governance forum. Please read the full post and share any feedback on the forum.

Congrats to grantee @fluiditymoney on their launch! Fluidity allows Aave to capture liquidity from money that is on the move 🌊💸

Catch up on everything Increment has achieved this year towards building decentralized perpetuals on zkSync 2.0 💹

Get excited for Buckets - a decentralized one-stop shop fit to users’ goals. Join their Discord to get involved in testing their beta which is launching soon 🎯

The Aave-chan Initiative (ACI) continues to be active as the most recent delegate to submit a platform on the forum. The ACI got a large boost with @lemiscate sharing he is focusing on it full time going forward 👻

// Governance ⚖️ - written by Boardroom

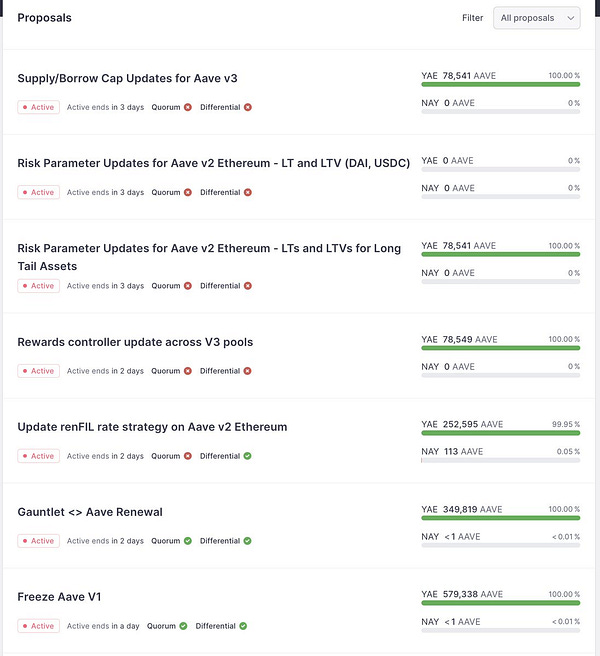

Lots of proposals coming through, as usual of late. A couple of these are re-submissions of proposals that failed to meet quorum. @fig posts here with some ideas about how to address that issue.

@bgdlabs has posted an update on the status of the Aave v3 Ethereum release.

/ Proposals

👻 Aave Improvement Proposals:

Freeze Aave V1 (132). This has been resubmitted after failing to reach quorum.

Aave v2 ETH Interest Rate Curve Update (131). This proposal to amend “the ETH interest rate parameters on the Aave Ethereum v2 and v3 Liquidity Pool” was executed on December 18 after 100% voted “YAE.”

Set LDO, stMATIC, MaticX and SD Emission_Admin for Polygon v3 Liquidity Pool (130). This proposal was resubmitted and executed on December 17 after 100% voted “YAE”.

⚡️ Now on Snapshot:

[ARFC] BAL Interest Rate Curve Update. Llama proposes to “amend BAL interest rate parameters on the Aave Ethereum v2, Ethereum v3 (when deployed), Polygon v3 and Polygon v2 Liquidity Pools.”

[ARFC] Aave v3 Polygon wMATIC Interest Rate Update. Llama proposes to “amend the wMATIC interest rate parameters on the Aave Polygon v3 Liquidity Pool.”

Authorise the release of Aave <> Chainlink Proof of Reserve for Aave Avalanche. This proposal “authorises BGD to proceed with the release of Aave <> Chainlink Proof of Reserve Phase 1, targeting Aave v2 & v3 Avalanche.”

[ARC] Updated: Gauntlet <> Aave Renewal. This is a revised proposal to continue the engagement for “continuous market risk management.”

[Temp Check] Deploy Aave on Metis. This is a proposal to deploy Aave on the EVM equivalent L2.

[ARFC] Aave DAO Policy Change: Halt Listings on all Aave v1 & v2 Non Permissioned Deployments. This proposal was resubmitted and passed on December 17 with nearly 100% voting “YAE.”

[ARFC] Receipt of Gauntlet Insolvency Fund. This proposal passed on December 16 with almost 93% voting “YAE.”

[ARFC] Ethereum v2 Collector Contract Consolidation. This proposal passed on December 16 with almost 100% voting “YAE.”

[ARFC] Repay Excess CRV Debt on Ethereum v2. Almost 66% voted to “use USDC to acquire CRV” on December 16.

🗣 Provide your feedback on these active Aave Requests for Comment (ARCs):

Update renFIL Interest Rate Strategy on Aave v2 Ethereum. BDG Labs says that “the offer/demand dynamics for renFIL” have been “disturbed,” and “recommend lowering to the minimum the parameters of the interest rate strategy, to not accumulate extra growth of renFIL on the borrowing side.”

Chaos Labs <> Aave v2 Coverage. @ChaosLabs proposes “to expand the scope of its engagement with Aave to include proactive risk analysis and management of the v2 markets while encouraging and supporting a safe migration to the upcoming Ethereum v3 deployment.”

[ARC] Aave v3 Polygon wMATIC Interest Rate Update. Discussion continues.

[ARC] Freeze RENFIL for Aave V2 ETH Market. Current situation explained by BGD Labs.

/ In the Forums

Delegate platforms are updated for Aave Chan Initiative, @PennBlockchain, StableNode, Flipside, and @lbsblockchain.

Aave runway analysis, provided by @Llamaxyz as of November 2022.

Financial Report for November 2022. Provided here by Llama.

Continuous formal verification report, provided by Certora for November 2022.

More thoughts on the risk council “problem space” for Aave.

E-mode pages have been added to Gauntlet’s Aave v3 risk dashboard.

/ On Twitter

Fake Aave account, watch out. Thanks to Marc Zeller.

Llama provides updates on their work with Aave in The Ranch. Updates also available via a recent Spaces event.

How Aave can leverage real-world assets, with Goldfinch.

Quick Gov Links: Governance FAQ | Governance Docs | Discord Governance Channel | Snapshot | AIPs | Aave on Boardroom

// Events 📆

ETHforAll: January 13th to 29th — Including $5k in prizes for building on top of Aave. Apply now and stay tuned for more details!

// Hey Anon 👻

What holiday slowdown? Be sure to participate and vote!