Aave News: Aave V3 Announced, Ampleforth AMA, Web3Jam, and More

A recap of the Aave ecosystem, November 1st to November 7th 2021

A newsletter to enjoy with the ENS airdrop, featuring coverage on Aave Weekly ⚡️, Risk 🔎 , Aave Grants DAO update 🏗 , State of the protocol 📰 , Ecosystem 🧉 , Governance ⚖️, Mark your calendar 📆 , and Water cooler 🆒Aave Weekly ⚡️

Aave Weekly ⚡️

Aave Weekly brings readers insights on protocol liquidity, income and other performance metrics.

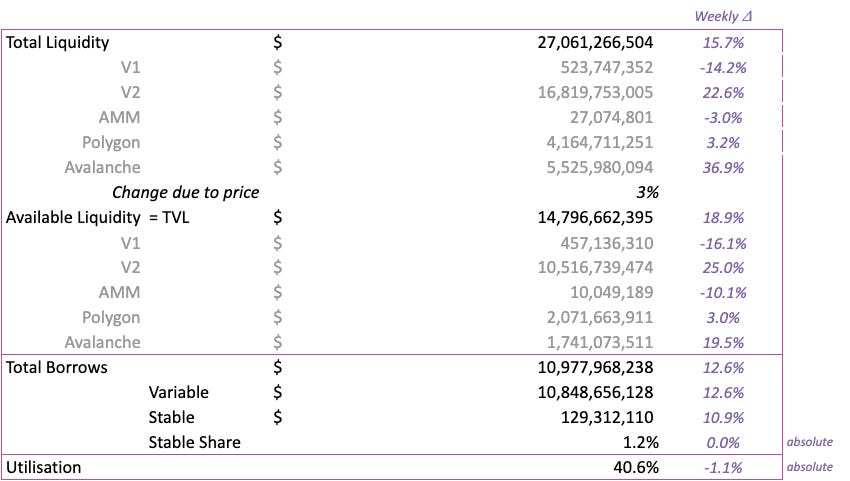

The Aave Protocol closes week 45 of 2021 with $27.1 billion of liquidity:

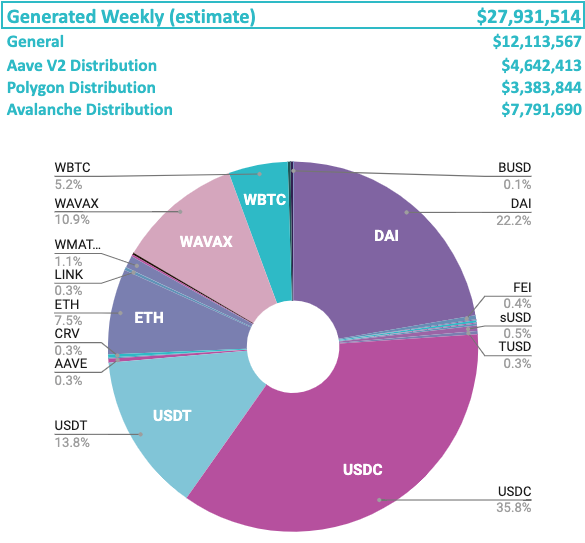

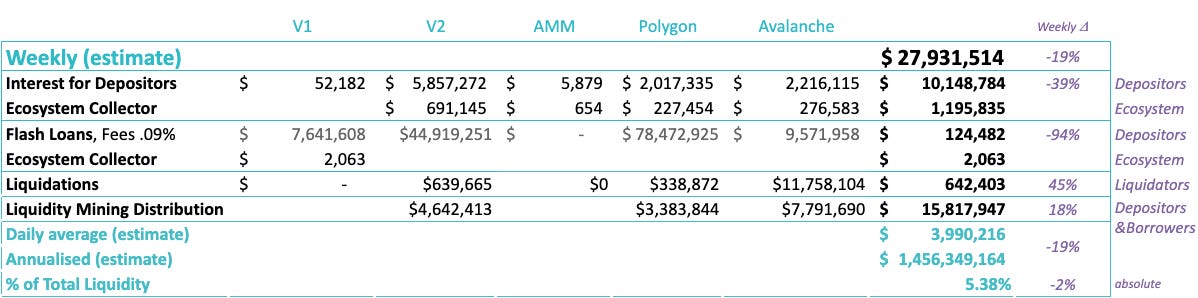

40.6% Utilisation, generating $10.2m of estimated interest for depositors

$141m of Flash Loan volume, generating $125k of fees for depositors

$12.7m liquidated, generating $642k of fees to liquidators

$1.2m for the ecosystem collectors now holding $29m

$12.1m generated by the protocol this week

With an additional $4.6m $StkAAVE, $3.4m $WMATIC & $7.8m $WAVAX distributed

*at the weekly close price

Protocol Liquidity

Protocol Usage

Safety Module

You can download the Aave Weekly pdf from the governance forum.

Risk 🔎

In case you haven’t seen it, check out the Aave Risk Dashboard by Gauntlet at gov.gauntlet.network/aave. The Gauntlet team is particularly keen on iterating on this dashboard for the community and would love feedback via this Google Form.

Risk Parameter Updates:

This week, AIP-44 passed and was executed. The AIP temporarily disables borrow for xSUSHI and DeFi Pulse Index (DPI), and freezes deposits, borrows, and rate swaps for UNI/BAL AMM Markets. Gauntlet’s analysis shows that any attempt to manipulate xSUSHI on the Aave Protocol would result in losses for the attackers under the current market conditions, but this AIP was proposed as a precautionary measure to mitigate the potential of any future risks.

In addition, this week’s set of parameter updates includes changes to liquidation threshold, loan to value, and liquidation bonus for the five assets below. The ARC for this set of parameter updates can be found here. For more detail on Gauntlet’s first two months of recommendations and their impact, please see Gauntlet’s Q2 Dynamic Risk Parameters and Monthly Risk Report.

Aave Grants DAO update 🏗

Vote for the best POAP. Calling all AGD Community Call and rAAVE attendees (with proof via POAP!) - you're eligible to vote for the winner of the Aave Snapshot POAP contest. Please browse the designs here and vote if you hold one of the eligible POAPs.

Ampleforth AMA. Join us for a live AMA with the @AmpleforthOrg team this Tuesday in the main Aave Discord #ecosystem channel. Have all your questions about lending and borrowing AMPL with Aave answered. Have a question? Reply here or DM @AaveGrants!

Forta Agent Contest. The latest @FortaProtocol Agent Contest is on now until November 10th. Interested developers can help protect the Aave protocol by choosing from five challenges for the chance to win up to $5000.

Web3Jam. We are sponsoring @ETHGlobal's last event of the year, Web3Jam from November 12th to November 24th. Apply now to join the virtual community hackathon and help build a web where users control their own data and identity. There are over $100k in prizes including $4000 in $AAVE.

Sacred AMA. Thank you to Aave grant recipient Sacred for joining the Aave community for an AMA where they chatted about all things privacy including what they are building, their future roadmap, and multi-chain privacy. Join their Discord to learn about Sacred or geek out on privacy conversations. Experience earning yield while transacting privately on Kovan and submit any feedback to their Feedback Bounty Program.

State of the protocol 📰

Aave V3 was announced and a Snapshot vote is currently live to get the community's support to deploy V3. New features and upgrades include: Portal, High Efficiency, Isolation Mode, risk management improvements, and L2-specific features. Read through the whole post to get more details on what is in store and next steps. Throughout the week, more details and insights emerged like:

The upgrade from V2 to V3 is possible without users needing to migrate their positions

Aave could become the railway where liquidity moves as protocols plug into Aave for cross chain liquidity

eMode could enable super efficient FX trading

What are you most looking forward to with Aave V3?

Ecosystem 🧉

The multisig for the Risk DAO has been set up and the funding proposal should be live soon

Apply to work for Aave Grant recipient Solace and help build cross-chain DeFi coverage products - they are hiring for all roles!

Earn up to 1.34 $AAVE by solving one of three questions from Flipside Crypto

Makers D3M is live and 10 million DAI has been supplied directly from Maker to Aave V2 - overview from the Defiant 👀

Instadapp's classic strategies are now live for Aave on Avalanche

Ribbon Finance launched a covered call vault for Aave which allows users to generate yield in their $AAVE

Stani was on the Scoop to discuss Aave's history from ETH Lend to Arc, why Aave is building decentralized social, and the current state of DeFi 🌊

Stani was on a panel talking about the future of NFTs at @NFT_LDN with @m1guelpf, @Nifty_Table, and @ricgalbraith

Governance ⚖️

On-chain votes:

Disable borrow for xSUSHI and DPI. Freeze reserves for UNI and BAL AMM Markets | Governance discussion | Last Monday AIP-44 was executed which takes precautionary measures to protect Aave V2. Read more in Risk 🔎

Snapshot votes:

Should Aave V3 be released? | Governance discussion | See more in State of the protocol 📰

🗳 Voting is open from now to November 11thShould Aave deploy strategies on sidechains as well, or mainnet strategies only? | Governance discussion | The community voted to build treasury strategies on multiple chains opposed to only focusing on mainnet strategies

Should Gauntlet's Dynamic Risk Parameter engagement be renewed for Q2? | Governance discussion | Gauntlet request to renew their engagement for Q2 showed relative support from the community - the main opposition raised was due to cost

Should 7 total risk parameters across 5 Aave V2 assets be adjusted? | Governance discussion | As part of Gauntlet's ongoing risk monitoring this AIP changes 7 parameters across 5 Aave V2. Read more in Risk 🔎

Other posts to watch:

Add support for Terra USD (UST) | A proposal to add UST to Aave V2

ARC - Aave V2 - Liquidity Mining Program (90 days at 30% reduced rate) | An initial proposal for renewing the liquidity mining program. Look out for a second version from @Matthew_Graham_ incorporating the feedback shared on certain parameters and distributions from the community.

Mark your calendar 📆

AMA with Ampleforth - November 9th @ 10am PT | 1pm EST | 5pm UTC

Web3Jam - November 12 - 24

FTX GalAxie Cup - November 27 - 28

Stani will be speaking at Permissionless (May 17 - 19, 2022) and CFC St. Moritz (January 12 - 14, 2022)

Water cooler 🆒

Aave V3 good. Don't overthink this one anon.

Join the Aavengers:

Browse RFPs: https://aavegrants.org/Request-for-Proposals-160203ba5d1746daae31588924a6680a

Chat with the community on Telegram: https://t.me/aavegrantsdao

Join the governance forum: https://governance.aave.com

Learn more about AGD: https://aavegrants.org/