Aave News: AaveGrants.lens, Permissionless Recap, Analyst Role, Risk Review, and More 🌿👻

A recap of the Aave ecosystem, May 16th to May 22nd

For anyone following us on Lens 🌿, featuring: Risk 🔎 | Protocol 📰 | Ecosystem 🧉 | Governance ⚖️ | Events 📆 | Hey Anon 👻

Risk 🔎

In case you haven’t seen it, check out the Aave Risk Dashboard by Gauntlet at gov.gauntlet.network/aave. The Gauntlet team is particularly keen on iterating on this dashboard for the community and would love feedback via this Google Form.

For more details on how Gauntlet manages market risk for Aave, please see Gauntlet’s Parameter Recommendation Methodology and Gauntlet’s Model Methodology.

Risk Parameter Updates:

Details can be found in this AIP

AIP-75 has been passed and executed.

Due to market conditions around UST and related oracle unreliability, Gauntlet proposed freezing UST.

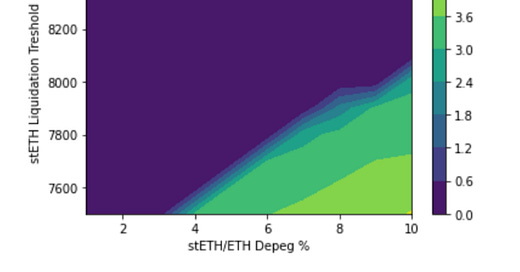

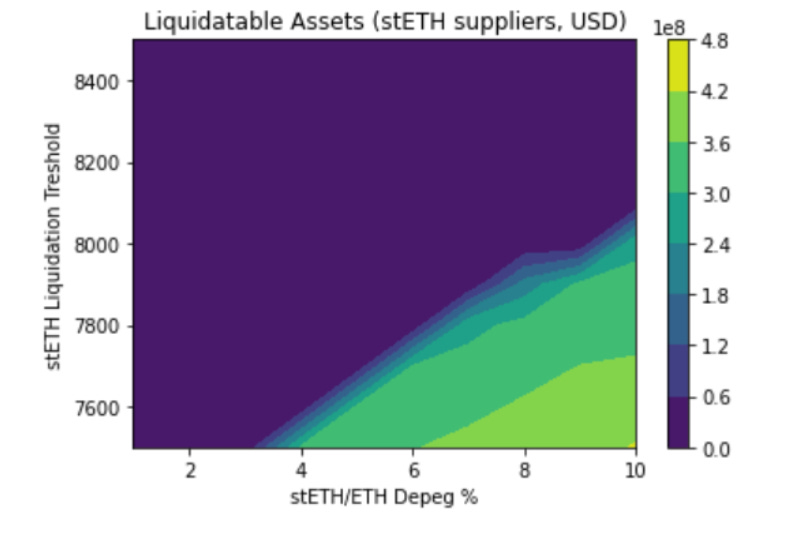

Due to uncertainty around the stETH peg, Gauntlet also proposed increasing stETH liquidation threshold to 81% and decreasing stETH LTV to 69%.

This allows borrowers using stETH as collateral with more buffer in case stETH continues to depeg, and thus decreases the chances of liquidation cascades that lead to insolvency on the Aave platform. stETH LTV has also been decreased, so new positions will not be able to take on riskier positions using stETH as collateral. Our analysis indicated that an 81% liquidation threshold for stETH should allow for the protocol to withstand an additional 10% depeg from stETH and ETH price. Gauntlet's simulations of the Aave protocol indicated that a decrease in LTV to between 66-69% and an increase in liquidation threshold to 81-82% could significantly decrease liquidation volume as well as total insolvencies while minimally decreasing capital efficiency.

Market Downturn Risk Review:

Details can be found in this Risk Review

We wanted to provide the community with an update given the notable market downturn over the past few weeks. We have been analyzing the markets closely and have observed no meaningful insolvencies that occurred on Aave V2 during the market crash.

From May 8th to May 15th, Aave v2 experienced around $109M in liquidations primarily driven by ETH and WBTC. These are liquidations that were healthily absorbed by the market (i.e., did not lead to insolvency).

Aave v2 experienced no major insolvencies other than several minor dust accounts, with the largest account being just ~$400 in insolvency.

Protocol 📰

Learn why the Aave x Balancer USD Boosted Pool is the best place for stablecoins including updates on weekly volume and integrations

Certora announced their grants program to encourage researchers to write security procedures - get paid $2,000 to improve the security of DeFi

Ecosystem 🧉

Thank you to everyone who came and said hi at Permissionless and big thanks to everyone who saw ghosts live on stage: Stani, Rebecca, Christina, Steve, & Steven 👻

You can now track your YOLO order balances from Symphony Finance on Zapper 🎵

Vote for Minke on Product Hunt - also be sure to check out their app by the end of the month for a chance to win $5000 in AAVE 🌊

Check out the Solace roadmap for 2022 to see how they are going to build the best insurance product in DeFi 🛡

Governance ⚖️

On-chain votes:

Add claimRewardsToSelf() to incentives for Ethereum V2 Aave Market | Governance discussion | Verified by BGD | 🗳 Vote until May 27th

Consolidate Reserve Factors and Enable Borrowing DPI | Governance discussion | ✅

Freezing UST and Updating stETH Parameters | Governance discussion | ✅

Snapshot votes:

Add StakeWise's sETH2 on Aave v2 Mainnet Market | Governance discussion | 🗳 Vote until May 25th

Other discussions from the forum:

Events 📆

Hey Anon 👻

Are you interested in working at Aave Grants as an analyst?