Aave News: CC6, Business License Favoured in Snapshot Vote, the Next Iteration of Aavenomics, and More

A recap of the Aave ecosystem, December 6th to December 12th 2021

For anyone who is excited about what will be built on top of Aave v3, featuring coverage on Aave Weekly ⚡️ , Aave Grants DAO update 🏗 , State of the protocol 📰 , Ecosystem 🧉 , Governance ⚖️, Upcoming events 📆 , and Water cooler 🆒

Aave Weekly ⚡️

The Aave Weekly Newsletter brings readers insights on protocol liquidity, income and other performance metrics.

The Aave Protocol closes week 50 of 2021 with $25.4 billion of liquidity:

44.2% Utilisation, generating $9.9m of estimated interest for depositors

$94m of Flash Loan volume, generating $83k of fees for depositors

$7.0m liquidated, generating $501k of fees to liquidators

$1.6m for the ecosystem collectors now holding $36.7m

$12.0m generated by the protocol this week

With an additional $1.9m $StkAAVE, $3.5m $WMATIC & $2.4m $WAVAX distributed

*at the weekly close price

**Polygon figures are approximated due to the Graph data being out of sync

Protocol Liquidity

Protocol Usage

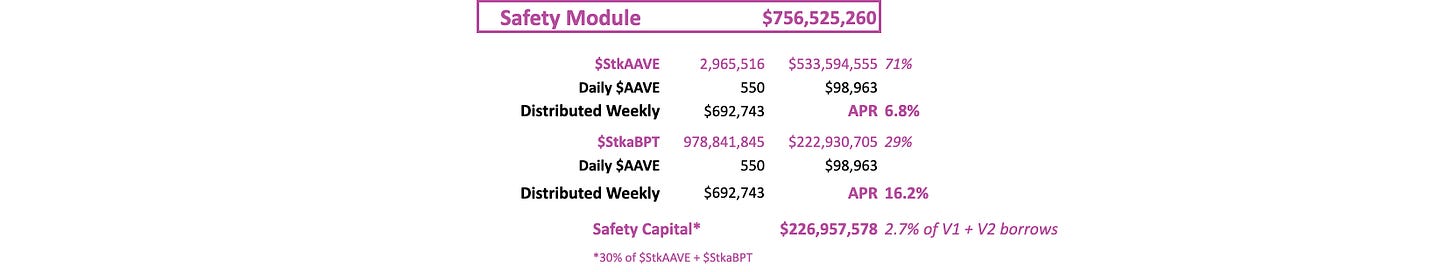

Safety Module

You can download the Aave Weekly pdf from the governance forum.

Aave Grants DAO update 🏗

Shout out to all the speakers and attendees at the sixth Aave Grants community call. Keep reading for an overview from each speaker. (Note: any omissions or errors are from the author).

Updates from Aave Grants - @HelloShreyas and @_alekslarsen

The proposal to renew Aave Grants is currently live, look out for on-chain vote soon

Check out the list of high priority RFPs including:

a community owned and fully featured governance interface

the Developers DAO who will, over time, take over full development of smart contracts and other protocol features

any proposals that bring stable coin growth to Aave or other integrations

Updates from Aave core team - @StaniKulechov and @The3D_

Aave v3 is nearing the finish line. The conversation around which code licensing to use is underway, five audits are happening in parallel for formal verification, and the front end is being adopted to support the new functionality

Once the licensing vote happens, the code base can be released and the bug bounty can begin

There have been many community led proposals to iterate on the current version of the protocol including Gelato adding G-UNI to the AMM Market, proposals to list ENS and stETH, and refreshing the available collateral on Polygon

Updates from grant recipients:

Next gen self custody wallet utilizing gnosis safe multisigs focused on bringing the next billion users to DeFi a more secure and user friendly design

Join the waitlist at linen.app for a chance to win up to $25k in prizes

@AlexisMasseron from @JellyFi_Eth

Capital-efficient DeFi lending protocol that enables crypto loans without collateral

There is no idle capital because any capital not loaned out is earning interest through Aave

Raised a seed round two months ago and are aiming to launch in Q1 after getting the green light from auditors 👀

@crypto_janice from @Entropyfi

Making earning yield fun by allowing users to stake stable coins and make predictions on different asset prices to earn yield

An exclusive staking pool for $GHST and Aavegotchi holders is currently live - users can earn yield and their governance token ($ERP) which will be needed to play prediction games once v2 launches in 2022

Manlio from @HAL_Team

Bridging the gap between blockchains and web2 by making it easy to connect centralized and decentralized protocols

Aave has one of the most active communities in terms of triggers executed - mainly for position monitoring (Health factor, borrow/lend rates)

Avalanche integration coming soon 👀

Shared a proposal to build their push notification system directly into the Aave front end to help remove the friction of monitoring their position

Updates from the Community:

@cjhtech and @revrfg from @atlantis0x | Website

Building an accessible and community owned web3 metaverse with social, gaming and education all in one

They integrate web3 or DeFi applications in a novel way to gamify the process of onboarding new users e.g. users can walk into the Aave Bank Building and learn about the protocol while getting help making their first deposit and in the future these quests could be incentivized

Currently building the next version called Atlantis City Alpha that could include an upgraded Aave Bank, Aave Grants DAO Clubhouse, and even Aave City as a token gated community

@sepu85 from @gooddollarorg

UBI protocol aiming to include the next 100 million people into crypto and DeFi by lowering the entry barrier which is have the capacity to save

Launching v2 where DAOs can stake part of their treasury to contribute to UBI distribution - see their proposal for Aave

State of the protocol 📰

After a late vote, the temperature check to determine which license to release V3 under swung in favour of 'Business License' while 'MIT License' was leading for the majority of time the vote was open. @GuardAOR goes deep on what this means if readers want to learn more 👻

Gelato's proposal to Make the AMM Market Great Again went live so users can now add G-UNI DAI/USDC and G-UNI USDC/USDT as collateral in the Aave v2 AMM Market

Discussions are happening around the next iteration of Aavenomics, including implementing a veCRV model

HAL shared a proposal to add their notification system to the Aave UI

Ecosystem 🧉

JellyFi released a new website sharing what they have been working on for the past few months and announced a $4.4m raise to continue bringing uncollateralized loans to DeFi 🐙

Kakashi from Symphony Finance teased their redesigned interface 🎵

The second round of EntropyFi's $ERP mining pool for $GHST and Aavegotchi holders is live

Stakeall.Finance went live with their one-stop DeFi platform for staking allowing users to maximize staking returns

Solace recapped a busy week including new listings, new hires, and their upcoming DeFi coverage marketplace

Interacting with Aave was part of the recent Polygon Scavenger Hunt from Flipside Crypto

The Centrifuge team had a Q&A on how the first permissioned market for real-world assets built on Aave

Instadapp announced an Aave debt migration bridge between Ethereum and Polygon 🌉

Governance ⚖️

On-chain votes:

Add G-UNI to Aave V2 AMM Market | Governance discussion | The proposal to add Gelato’s G-UNI DAI/USDC and G-UNI USDC/USDT pools as collateral to Aave’s AMM market passed ✅

Snapshot votes:

Certora Continuous Formal Verification for Governance and Aave Community | Governance discussion | 🗳 Voting is live until December 20th

Under what license the have protocol should be released? | Governance discussion | Final result: Business License 55.44% (387.75k AAVE), MIT 44.28% (309.69k AAVE)

Other discussions:

Can we introduce some incentives/utility for holding AAVE token?

Add V2 Market assets to Polygon Market that are relevant to Polygon Network

Upcoming Events 📆

DefiCon - December 18 - 19, 2022 🥳

ETHDenver - February 11 - 20, 2022

Stani will be speaking at Permissionless (May 17 - 19, 2022) and CFC St. Moritz (January 12 - 14, 2022)

Water cooler 🆒

Stani and Emilio flexed the power of eMode coming in v3 - hello 98% LTV and 1.03 Health Factors 👀