Aave News: Design a POAP to win $1000, Forta Agent Contest, Sacred AMA, Precautionary AIP, and More

A recap of the Aave ecosystem, October 25th to October 31st 2021

A newsletter made by ghosts for ghosts, featuring coverage on Aave Weekly ⚡️, Risk 🔎 , Aave Grants DAO update 🏗 , State of the protocol 📰 , Ecosystem 🧉 , Governance ⚖️, Mark your calendar 📆 , and Water cooler 🆒

Share Aave News with someone you know who wants to learn more about Web3!

Aave Weekly ⚡️

The Aave Weekly Newsletter brings readers insights on protocol liquidity, income and other performance metrics.

The Aave Protocol closes week 44 of 2021 with $23.4 billion of liquidity:

41.7% Utilisation, generating $16.7m of estimated interest for depositors

$2.4 billion of Flash Loan volume, generating $2.2m of fees for depositors

$8.0m liquidated, generating $442k of fees to liquidators

$1.9m for the ecosystem collectors now holding $30.8m

$21.2m generated by the protocol this week

With an additional $4.4m $StkAAVE, $3.2m $WMATIC & $5.8m $WAVAX distributed

*at the weekly close price

Protocol Liquidity

Protocol Usage

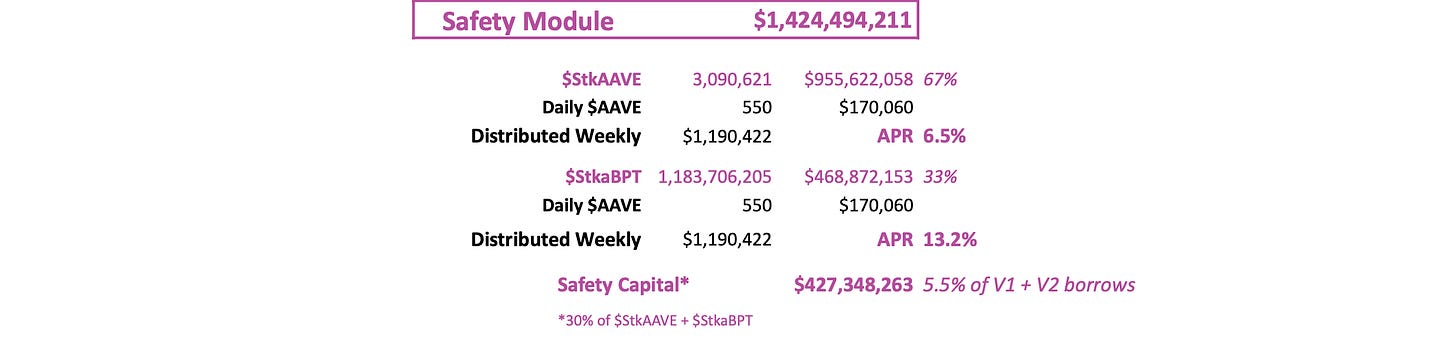

Safety Module

You can download the Aave Weekly pdf from the governance forum.

Risk 🔎

In case you haven’t seen it, check out the Aave Risk Dashboard by Gauntlet at gov.gauntlet.network/aave. The Gauntlet team is particularly keen on iterating on this dashboard for the community and would love feedback via this Google Form.

Risk Parameter Updates:

Details can be found in this AIP

This week's set of parameter updates have passed and includes changes to liquidation threshold, loan to value, and liquidation bonus for the three assets below. For more detail on Gauntlet’s first two months of recommendations and their impact, please see Gauntlet’s Q2 Dynamic Risk Parameters and Monthly Risk Report.

Aave Grants DAO update 🏗

Best POAP wins $1000. Design a customizable POAP that can be added to future Aave Snapshot votes to recognize voters and you could win $1000 in AAVE. Submit all designs to the #poap-contest channel in our Discord - submissions are due by 11pm UTC this Wednesday. Full details here.

Forta Agent Contest. We are excited to be partnering with @FortaProtocol, the first decentralized runtime security network for smart contracts, for their next Agent Contest starting November 3rd. Developers will help monitor and secure the Aave Protocol and have the chance to win up to $5000. Join the Forta Discord to learn more.

Sacred AMA. We are hosting an AMA with grant recipient Sacred - they allow users to transfer funds privately while earning interest through Aave. Imagine if Tornado cash and Aave had a baby 👶 What do you want to know? Reply to this Twitter thread with any questions

State of the protocol 📰

Precautionary AIP. The Gauntlet team with help from many big brains across the ecosystem came together to mitigate a potential risk that was discovered in wake of the Cream exploit. While economic conditions did not allow for the exploit to be profitable on Aave, an AIP was proposed to suppress any vulnerability. The proposal has passed and is queued to be executed.

Ecosystem 🧉

Listen to Stani discuss the future of DeFi, NFTs as collateral, building a decentralized social media platform, and more on the Empire podcast with @JasonYanowitz and @santiagoroel

@MalusLabs dropped a progress update on the governance forum. They provide 7% peer to peer cash back to users using Aave’s aTokens as collateral and are currently live on Rinkeby.

Check out easy and hard questions from Flipside questions to win up to 1.53 $AAVE

Maker has an executive proposal up for voting that includes onboarding the Aave DAI Direct Deposit Module. If this passes, Maker will begin depositing DAI directly into the Aave v2 market starting with a max amount of 10 million DAI.

Governance ⚖️

Boardroom now includes an Aave governance update in their DAOs Weekly thanks to @mori_eth - check it out for an overview on proposals and forum discussions.

On-chain votes:

Risk Parameter Updates 2021-10-21 | Governance discussion | As part of Gauntlet's ongoing risk monitoring this AIP changes 4 parameters across 3 Aave V2. Read more in Risk 🔎.

Disable borrow for xSUSHI and DPI. Freeze reserves for UNI and BAL AMM Markets | Governance discussion | Precautionary measures taken to protect Aave V2. Read more in State of the protocol 📰 .

Snapshot votes:

Should Aave deploy strategies on sidechains as well, or mainnet strategies only? | Governance discussion | Llama outlines the benefits and the drawbacks to building strategies on each chain versus only focusing on mainnet strategies.

🗳 Voting is open until November 6th - signal your choice and join the conversation!

Other posts to watch:

ARC - Aave V2 - Liquidity Mining Program (90 days at 30% reduced rate) | An initial proposal for renewing the liquidity mining program. Look out for a second version from @Matthew_Graham_ incorporating the feedback shared on certain parameters and distributions from the community.

Mark your calendar 📆

@FortaProtocol Agent Contest - Wednesday, November 3, 2021

AMA with Sacred - Thursday, November 4, 2021 at 4pm UTC

FTX GalAxie Cup - November 27 and 28, 2021: Check out the tournament format

Other events featuring Aavengers:

@chainyoda on a panel at Cosmoverse - November 5 and 6, 2021

Stani speaking at Permissionless - May 17 to 19, 2022

Water cooler 🆒

Frens. Building the future of France is better with frens 🤝

Join the Aavengers: