Aave News: rAAVE Amsterdam, V3 Builders 🧵, Brew Mobile App Spotlight, and More

A recap of the Aave ecosystem, March 28th to April 3rd 2022

For anyone reading from our Greek community, featuring: Spotlight 🔦 | Risk 🔎 | Protocol 📰 | Ecosystem 🧉 | Governance ⚖️ | Events 📆 | Hey Anon 👻

Brew: Grantee Spotlight 🔦

Introducing Brew, a mobile app that enables users to deposit stablecoins on different DeFi Protocols and earn high yield including with aUSDC on Polygon.

The beta version just launched and they would love feedback from the Aave community. You can try out the mobile app with as low as $50 and no fees (iPhone US only except NY and Texas) 👻

Risk 🔎

In case you haven’t seen it, check out the Aave Risk Dashboard by Gauntlet at gov.gauntlet.network/aave. The Gauntlet team is particularly keen on iterating on this dashboard for the community and would love feedback via this Google Form.

For more details on how Gauntlet manages market risk for Aave, please see Gauntlet’s Parameter Recommendation Methodology and Gauntlet’s Model Methodology.

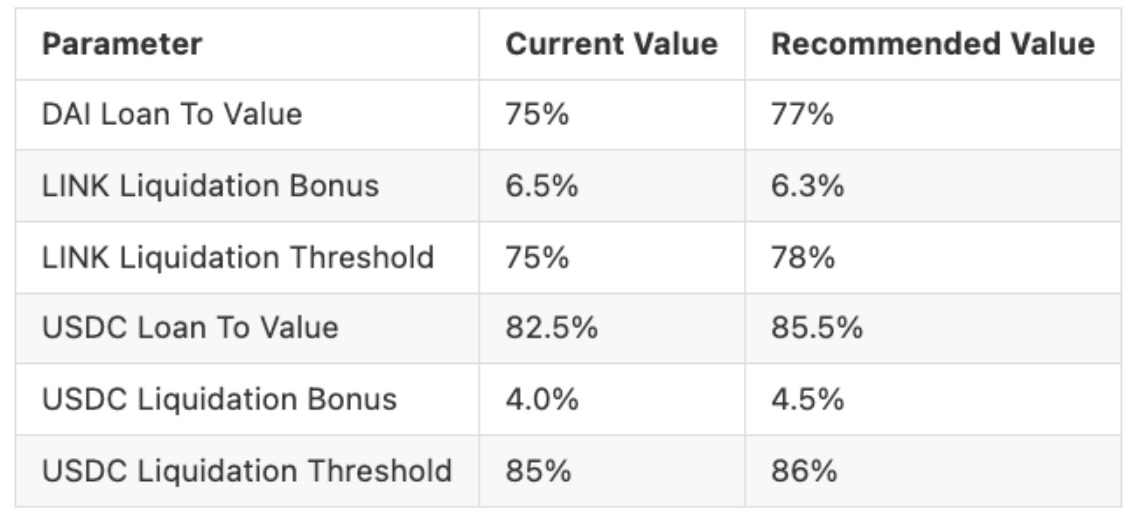

Risk Parameter Updates:

Details can be found in this AIP

A proposal is currently live to adjust six (6) total risk parameters across three (3) Aave V2 assets.

This set of parameter updates seeks to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets. Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Parameter recommendations seek to optimize for this objective function. Gauntlet’s agent-based simulations use a wide array of varied input data that changes on a daily basis (including but not limited to, asset volatility, asset correlation, asset collateral usage, DEX / CEX liquidity, trading volume, expected market impact of trades, and liquidator behavior). These simulations tease out complex relationships between these inputs that cannot be simply expressed as heuristics.

Protocol 📰

Curious to learn more about V3? Dive into an overview of the new features from CoinGecko and see supply caps in action 💪

Want to build on top of V3? Check out this awesome list of ideas waiting to be built for inspiration 🧵

Need support with your idea? Apply for a grant 🚀

After a successful on chain vote, the proposal from Instadapp to change the ETH yield curve is now live which increases the capital efficiency of borrowing ETH and the revenue for the protocol ⚡️

Check out Aave’s Financial Statements for February 2022 from Llama 🦙

Ecosystem 🧉

Get paid to build complex dashboards with Dune on top of Aave

Explore the ‘Leverage Stake’ strategy that borrows assets from Aave from Stakeall Finance’s recent mainnet launch

Read updates from Increment including their upcoming beta in their newsletter

On the Frax Finance governance forum, a proposal was created to add anFXS gauge for aFRAX token deposits on Aave - this would incentive lending but what about incentivizing borrowing?

Catch up with what Stani has to say... this week he joined the Bankless podcast, was quoted in a Metaverse and Money report, and had a panel conversation, “In Search Of Yield: Staking, DeFi and The Next Phase Of Institutional Adoption’

What do you think of this new Aave logo? Designed by @paranoid_dzn

Governance ⚖️

On-chain votes:

Snapshot votes:

Aave <> BGD Labs. Request for Approval | Governance discussion | Voting open until April 11 🗳

Add stMATIC to Aave V3 Polygon Market | Governance discussion | Voting open until April 6th 🗳

Should six (6) total risk parameters across three (3) Aave V2 assets be updated? | Governance discussion | Voting open until April 5 and then it will move to an AIP 🗳

Other discussions from the forum:

Events 📆

Solidity Fridays featuring @The3D_ - April 18

Aave Grants Community Call - April 12 @ 4PM UTC (look out for more details SOON)

ETHAmsterdam - April 22 - 24

rAAVE Amsterdam - April 24

Permissionless - May 17 - 19

Hey Anon 👻

Hey Anon, why are people talking about Aave again?