Aave News: YOLO with Symphony Finance 🎵, HackMoney Winners, Aave Seatbelt, Boosted DAI Rewards, & More

A recap of the Aave ecosystem, May 23rd to May 29th

For anyone who remembers when Aave was only on one chain, featuring: Spotlight 🔦 | Risk 🔎 | Protocol 📰 | Ecosystem 🧉 | Governance ⚖️ | Events 📆 | Hey Anon 👻

Spotlight: Symphony Finance 🔦

Symphony’s signature product is YOLO (Yield Optimized Limit Orders) which allows users to earn yield on their tokens while waiting for a limit order to execute. Symphony has not stopped shipping since receiving their grant and they recently crossed $10mm in total volume. Join their Twitter Spaces this Wednesday to celebrate and get this sweet POAP 👻🤝🎵

Risk 🔎

In case you haven’t seen it, check out the Aave V2 Risk Dashboard by Gauntlet at gov.gauntlet.network/aave. Gauntlet has also launched the Aave Arc Risk Dashboard. The Gauntlet team is particularly keen on iterating on this dashboard for the community and would love feedback via this Google Form.

For more details on how Gauntlet manages market risk for Aave, please see Gauntlet’s Parameter Recommendation Methodology and Gauntlet’s Model Methodology.

Risk Parameter Updates:

Details can be found in this ARC

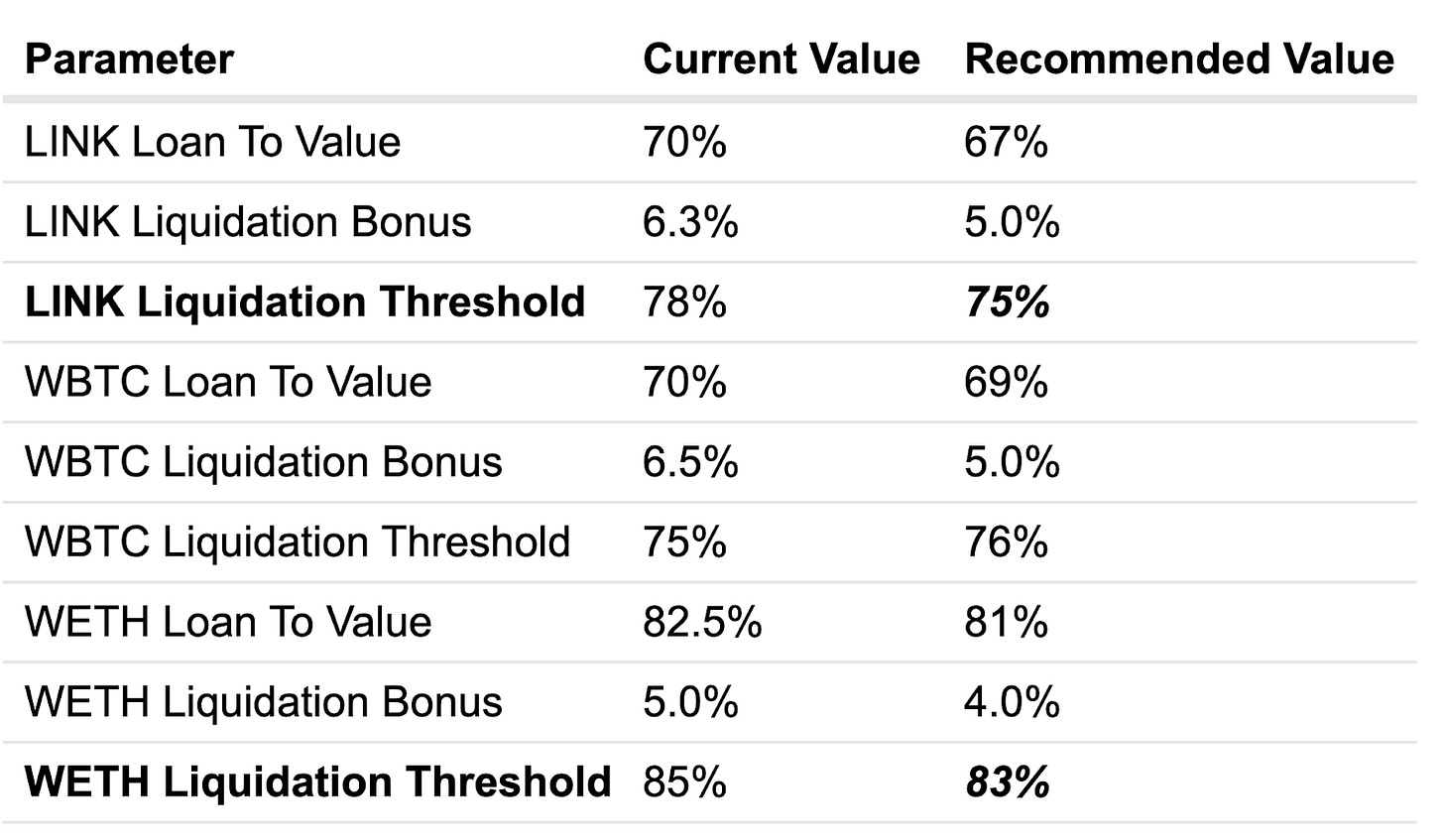

Gauntlet proposes adjusting nine (9) total risk parameters, including LTV, Liquidation Threshold, and Liquidation Bonus across three (3) Aave V2 assets.

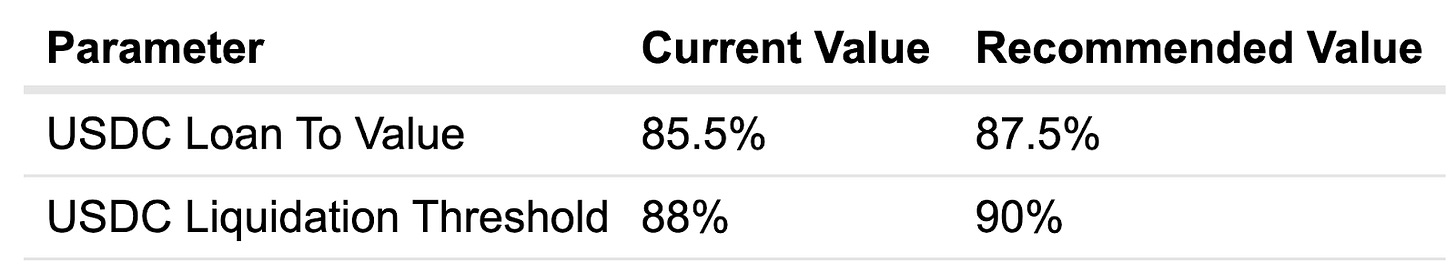

In addition, this ARC proposes adjusting two (2) total risk parameters, including LTV and Liquidation Threshold, across one (1) Aave Arc (Fireblocks) asset. These parameter updates represent Gauntlet’s first set of parameter updates for the Aave Arc market.

This batch update of risk parameters aligns with the Moderate risk level chosen by the Aave community. These parameter updates are a continuation of Gauntlet’s regular parameter recommendations. Following the recent market crash, our simulation engine has ingested the latest market data to recalibrate parameters for the Aave protocol. Please note that this set of parameter changes will be lowering liquidation threshold for LINK and WETH. Voting for these parameter changes will begin on Tuesday, May 31.

Aave V2 Parameter Changes Specification:

Aave Arc (Fireblocks) Parameter Changes Specification:

Protocol 📰

bgdlabs announced Aave Seatbelt - an evolution of Seatbelt by Uniswap that is able to analyze governance proposals, show the resulting changes, and generate a human readable report of all the interactions 🚀

Say hello to boosted AVAX rewards on the Aave Avalanche DAI market - check it out if you want to put your stables to work 🔺

Ecosystem 🧉

HackMoney wrapped up this week - congrats to all the hackers including the 30+ teams who built on top of Aave & the four winning teams: Smart Wallet, InchiTrade, Yield Index, SePo 🎖

Watch out for Solace’s launch on Fantom planned for June 1st. Solace is the DeFi insurance product that dynamically updates as your portfolio changes and an Aave Grant recipient 👀

DeFiSaver launched support for Optimism and Arbitrum, including full Aave V3 Dashboards - automate your positions on L2 now 🥳

Thank you to our friends at Magic Mirror for producing a limited Aave NFT for early Aave user 👻

Governance ⚖️

On-chain votes:

Add claimRewardsToSelf() to incentives for Ethereum V2 Aave Market | Governance discussion | Verified by BGD | ✅

Snapshot votes:

ARC: Risk Parameter Updates for Aave V2 and Aave Arc (Fireblocks) 2022-05-26 | Governance Discussion | 🗳 Vote until May 31st

Add Transak fiat on ramp service on Aave | Governance Discussion | 🗳 Vote until June 5th

Add StakeWise's sETH2 on Aave v2 Mainnet Market | Governance discussion | ✅

Other discussions from the forum:

Events 📆

Hey Anon 👻

Are you interested in building on Lens Protocol? Check out their own grants program ran by Aave Companies going on now!